Assume There Is a Required Reserve Ratio of 10

The maximum total change in demand deposits in the banking system iii. It is the ratio of required reserves to deposits.

This Item Is Unavailable Etsy Burled Wood Coffee Table Coffee Table Wood Burled Wood

For the following questions assume there is a 10 required reserve ratio.

. If deposits are 20 million then 2 million 20 million x 10 must be held as required reserves. 25 If the required reserve ratio is 10 percent currency in circulation is 400 billion checkable deposits are 1000 billion and. 24 If the required reserve ratio is 10 percent currency in circulation is 400 billion checkable deposits are 1000 billion and excess reserves total 1 billion then the excess reserves-checkable deposit ratio is.

A bank has 300 of reserves 300 of loans and 600 of deposits how much excess reserves are they holding. Assuming a required reserve ratio of 10 what is the largest amount in dollars by which the money supply can increase as a result of your action. Explain all the options and which one heshe is most likely to take.

If the Fed buys 10 million worth of government securities from the public. This result is given by the equation. Calculate each of the following.

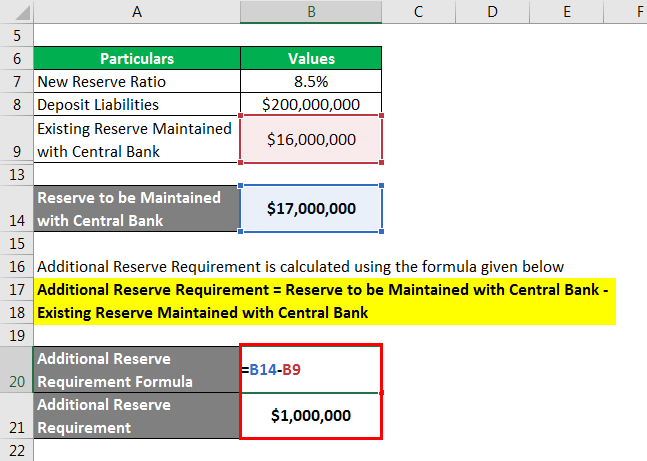

Assume a simplified banking system subject to a 10 percent required reserve ratio. Assume there is an economy with a single bank and the central bank sets the reserve requirement ratio at 10. Determine the cash reserve requirement of the bank for the year 2018.

The required amount by how much will the economys money supply increase. The required reserve ratio is. If the required reserve ratio is 10 percent this means that banks must hold 10 percent of their deposits as required reserves.

6 minutes If the required reserve ratio is 10 what actions should the bank manager take if there is an unexpected deposit outflow of 50 million. 10 must be held as required reserves. With a required reserve ratio of 10 the corresponding money multiplier is 10.

The bank could loan out this additional money making. 1 Attract more deposits thereby increasing both deposits and reserves by the same. How much could the bank make in additional loans right now.

Assume that the reserve requirement is 20 percent and banks hold no excess reserves. How much will the money supply increase after the money creation process is finished. The required reserve ratio is 10.

M m 1 rr m m 1 010 10. Pages 10 Ratings 100 4 4 out of 4. The banking system currently has 100 billion of reserves none of which are excess.

And just as a review thats the percent of deposits that the bank needs to keep as reserves and we can see that its at that reserve ratio right now. School San Francisco State University. Actual Reserve Ratio Reserves Deposits Actual Reserve Ratio 100 3100 Actual Reserve Ratio 323 In order to meet the required reserve ratio of 10 the bank can.

This means if a bank has deposits of 1 billion it. If a bank has 100000 of deposits a required reserve. If there is an initial increase in excess reserves of 90000 and all possible loans are made the money supply.

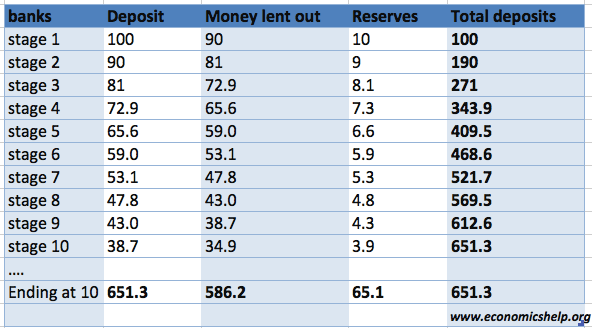

In particular if an additional 6667 are deposited into the bank thereby increasing deposits and reserves by 6667 then the. Assume also that the only bank had no transactions ie no loans reserves or deposits prior to an individual who deposits 10000 of. With a required reserve ratio of 10 percent the money multiplier is 110 10.

If the required reserve ratio is 10 percent this means that banks must hold 10 percent of their deposits as required reserves. From part c we know that the reserve requirement is 10. The bank is also not meeting the required reserve ratio of 10.

If the Fed lowers the reserve requirement to 5 percent and at the same time buys 10 billion worth of bonds then by how much does the money supply change. As a simplistic example assume the Federal Reserve determined the reserve ratio to be 11. With a money multiplier.

Course Title FIN 353. Since the bank has 450 in deposits there required reserves 45010 45. It has 2000 in deposits and so it needs to keep 10 as reserves 10 of 2000 is 200 so its at its minimum reserves already.

1 RESERVE RATIO 10 Amount to be retained 10000 10 1000 Amount that can be lend new deposit - amount to be retained 10000 - 1000 9000. Assume there is no leakage from the banking system and that all commercial banks are loaned up. They are holding 200 in reserves but they only need to be holding 45 so the bank has 155 in excess reserves.

Excess reserves are reserves over and above required reserves. The first thing we need to find is how much the bank is required to hold in reserve. People hold only deposits and no currency and the reserve requirement is 10 percent.

Experts are tested by Chegg as specialists in their subject area. 100 1 rating ANSWER. A Assume that Kim deposits 100 cash from her pocket into her checking account.

1 Required Reserve Ratio 10 a Reserves 200 Loans 200 Deposits 400 Now Excess Reserves Total Reserves - Required View the full answer. Excess reserves are reserves over and above required reserves. Assume that the required reserve ratio is 10.

We review their content and use your feedback to keep the quality high. If First National lends out its excess reserves of 140000 the money supply will eventually increase by 140000 x. If the Fed buys 10 million worth of government securities from the public the change in the money supply will be - ScieMce.

Bank deposits 138148 billion. If a bank has 100000 of deposits a required reserve ratio of 10 percent and. The required reserve ratio is 10.

What is the reserve ratio of 10. After the deposit outflow the bank will have a reserve shortfall of 15 million. The maximum dollar amount the commercial bank can initially lend ii.

Actual Reserve Ratio 600 6600 Actual Reserve Ratio 909 In order to meet the required reserve ratio of 10 the bank can. Given reserve ratio 10. In a simplified banking system with a 20 percent required reserve ratio a 1000 open-market sale by the Fed would cause the money.

Therefore the reserve to be maintained by Bank of America for the year 2018 can be calculated using the above formula as 10 138148 billion. If deposits are 20 million then 2 million 20 million x. 1Attract more deposits thereby increasing both deposits and reserves by the same amount from new or existing clients.

If the required reserve ratio is 1 to 10 that means that a bank must hold 010 of each dollar it has in deposit in reserves but can loan out 090 of each dollar.

Reserve Ratio Formula Calculator Example With Excel Template

3d Rendering Abstract Concept Of Global Network Internet And Global Communications Global Business And Make It Yourself Cloud Computing Services Supply Chain

Cbse Class 12 Marking Scheme 2020 For Accountancy Marking Scheme Class Schemes

Reading Money Creation Macroeconomics

29 Charts That Explain Americans Financial Lives Financial Chart American

Spotify S Valuation Assumes Full Stream Ahead Streaming Spotify Music Streaming

Credit Tips Do You Really Credit Score Tips

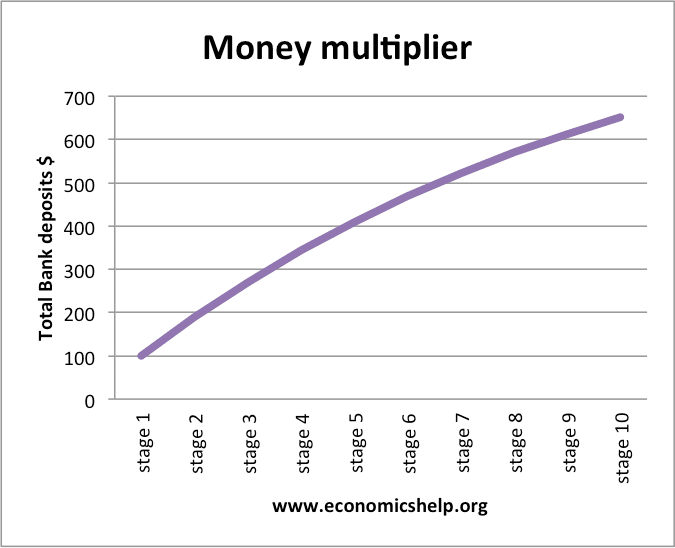

Money Multiplier And Reserve Ratio Economics Help

Pin By Trade Nivesh On Trade Nivesh Finance Bank Investment Advisor Kotak Mahindra Bank

Inflation And Subsequently The Cpi A Measure Of Inflation Is Often Controlled By The Fed The Federal Reserve Often Ha Consumer Price Index Index Consumers

How Resilient Are The Banks Resilience Asset Management Finance

Money Multiplier And Reserve Ratio Economics Help

Money Creation In A Fractional Reserve System Video Khan Academy

1979 Chevrolet Camaro Z28 K44 Kissimmee 2016 Chevrolet Camaro Camaro Classic Camaro

Pin By Toby Parrish On Watches Panerai Watches Panerai Radiomir Panerai

/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)

/dotdash_final_Deposit_Multiplier_Dec_2020-01-12355ee057a74ef1887bb1066444b606.jpg)

Comments

Post a Comment